That quiet, persistent thought, “I wish I was rich,” is a nearly universal human experience. It’s whispered during late-night worries about bills, dreamed of when scrolling through images of idyllic vacations, and felt deeply when opportunities seem just out of reach. This desire isn’t just about accumulating money; it’s a longing for freedom, security, and the power to shape your own life.

But for many, this powerful wish remains just that—a wish. It can feel like a distant fantasy, disconnected from the realities of daily life. The good news is that this longing can be the most powerful catalyst for change, transforming passive desire into an active, achievable plan for a richer life in every sense of the word.

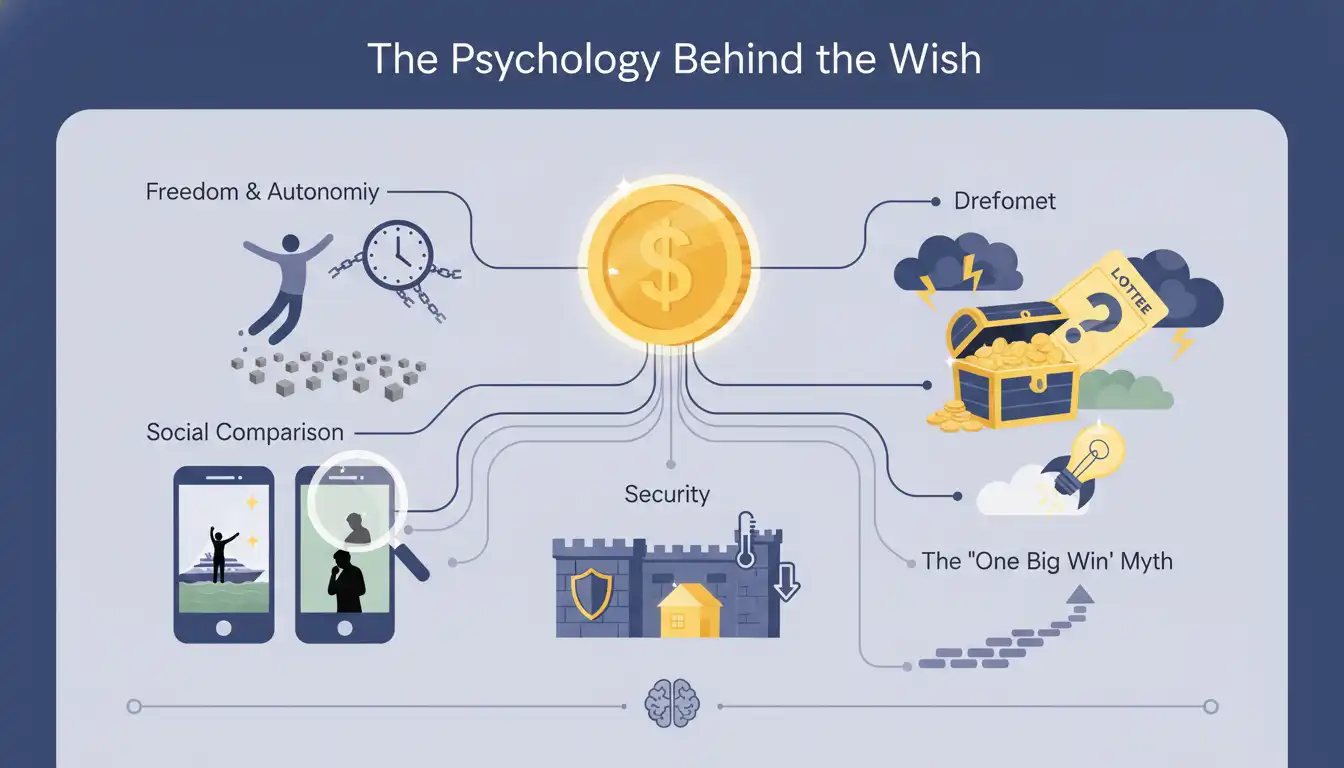

The Psychology Behind the Wish: Why Do We Crave Riches?

Understanding why we want to be rich is the first step toward achieving it. The desire is rarely about money for its own sake. It’s tied to deep-seated psychological and emotional needs that shape our perception of wealth and success.

One of the primary drivers is the pursuit of freedom and autonomy. We imagine that wealth would grant us the ability to escape obligations we dislike, pursue passions without financial constraint, and live life entirely on our own terms. This deep yearning for control over our time and choices is a powerful motivator.

Social comparison also plays a significant role in modern society. Curated social media feeds present a constant stream of lavish lifestyles, creating a powerful sense of inadequacy and fueling the desire to “keep up.” This external pressure can distort our view of what it means to be successful, tying self-worth directly to material possessions.

At its core, the wish for wealth is also connected to our primal need for security. Money represents a buffer against life’s uncertainties—unexpected medical bills, job loss, or economic downturns. The desire for a financial safety net is a rational response to a world filled with unpredictability, providing a sense of peace and stability.

Finally, many are captivated by the “one big win” myth, believing that wealth comes from a single lucky break like a lottery win or a viral business idea. This fantasy, while appealing, often prevents people from taking the small, consistent actions that build real, sustainable wealth over time.

Redefining “Rich”: What Does Wealth Truly Mean to You?

Before you can build a rich life, you must first define what that means for you. Society often presents a narrow, materialistic definition of wealth, but true richness is a deeply personal concept. It’s not a number in a bank account; it’s the resources you have to live the life you genuinely value.

True wealth is multidimensional and can be understood through four key pillars. Financial Wealth is having assets that generate income, providing security and opportunity. Time Wealth is having control over your own schedule, allowing you to invest your hours in ways that are meaningful to you. Health Wealth encompasses both physical and mental well-being, as without health, other forms of wealth are diminished. Social Wealth is the richness of your relationships with family, friends, and community, which provides support and fulfillment.

Take a moment to move beyond abstract desires and create a concrete vision for your ideal life. What would you do every day if money were no object? Where would you live? Who would you spend your time with, and what problems in your life would be solved? Answering these questions helps transform a vague wish into a tangible goal, providing a clear destination for your financial journey.

This process of redefinition is crucial. When your financial goals are aligned with your core values, your motivation becomes intrinsic and far more powerful. You’re no longer chasing a number; you’re building a life of purpose and fulfillment.

From Wishful Thinking to a Wealth-Building Mindset

The journey from wishing to achieving begins with a fundamental mental shift. Building wealth is less about secret formulas and more about cultivating a mindset that supports growth, discipline, and long-term vision. This internal work is the foundation upon which all financial success is built.

A crucial first step is moving from a scarcity mindset to an abundance mindset. Scarcity focuses on limitations, competition, and fear of not having enough. In contrast, an abundance mindset believes that there are ample opportunities and resources available, fostering creativity, optimism, and collaboration. This shift encourages you to see possibilities for growth rather than obstacles.

Embracing delayed gratification is another cornerstone of financial success. In a world that promotes instant rewards, the ability to resist immediate temptations for the sake of greater long-term benefits is a superpower. This discipline is what allows you to save, invest, and build assets rather than living paycheck to paycheck.

The concept of compounding is often associated with money, but its power extends to habits, knowledge, and skills. Every book you read, every new skill you acquire, and every positive habit you cultivate builds upon itself, creating exponential growth over time. Consistently investing in yourself is one of the most profitable actions you can take, creating returns that money alone cannot buy.

Ultimately, a wealth-building mindset is about viewing yourself as the primary architect of your financial future. It requires taking ownership of your decisions, learning from setbacks, and remaining committed to your vision, even when progress feels slow. This proactive and resilient approach transforms you from a passive wisher into an active creator of your own prosperity.

The Practical Blueprint: 5 Actionable Steps to Build Your Fortune

With the right mindset in place, the next stage is to translate your vision into a practical, actionable plan. Wealth is not built by accident; it is the result of deliberate and consistent actions. These five steps provide a clear blueprint to begin your journey from wishing to wealth.

Step 1: Confront Your Financial Reality (Without Fear)

Many people avoid looking at their finances closely, an experience that can feel as daunting as when one admits, “I hate going to the dentist.” However, just like a dental check-up, a financial check-up is essential for long-term health. You cannot build a solid future on an uncertain foundation.

Start by tracking your income and expenses for at least one month to understand exactly where your money is going. Instead of traditional, restrictive budgeting, consider adopting a “value-based spending” approach. This involves mercilessly cutting costs on things you don’t care about to free up funds for the things you truly love and value.

Step 2: Create a Gap Between Income and Expenses

The fundamental equation of wealth building is simple: spend less than you earn and invest the difference. To maximize this gap, you must focus on both sides of the equation. Look for opportunities to increase your income, whether through negotiating a raise, developing new skills for a promotion, or starting a side hustle.

Simultaneously, optimize your spending by identifying and eliminating “wealth drains”—small, recurring expenses that add up over time. Redirecting this money toward “wealth builders” like savings and investments is what fuels your financial growth. The goal is to make your money work for you, not just for your immediate consumption.

| Common Wealth Drains | Productive Wealth Builders |

|---|---|

| Unused subscriptions and memberships | Automated contributions to a retirement account |

| Daily expensive coffees and frequent dining out | Investing in low-cost index funds or ETFs |

| Impulse purchases and retail therapy | Building a robust emergency fund |

| High-interest credit card debt | Paying down debt to free up cash flow |

| Costly entertainment and convenience services | Investing in skills education or certifications |

Step 3: Make Your Money Work for You (The Magic of Investing)

Saving money is the first step, but investing is what truly builds wealth. Investing allows your money to grow through the power of compounding, where your returns start generating their own returns. You don’t need to be an expert or have a lot of money to start.

For most people, a simple and effective strategy is to invest in low-cost index funds or Exchange-Traded Funds (ETFs). These instruments provide broad market diversification without requiring you to pick individual stocks. The key is to start early and invest consistently, regardless of market fluctuations.

Step 4: Build High-Income Skills

While frugality is important, your ability to save is ultimately limited. Your ability to earn, however, is not. Shifting your focus from just saving pennies to actively increasing your earning potential is one of the most powerful levers for wealth creation.

Identify high-demand skills in your industry or adjacent fields that can lead to higher-paying opportunities. Consider areas like digital marketing, software development, sales, data analysis, or specialized trades. Investing in your own skills and knowledge provides a return that no market can ever take away.

Step 5: Automate Your Financial System

One of the most effective ways to ensure you follow your financial plan is to remove willpower from the equation. Set up an automated system where a portion of your paycheck is automatically transferred to your savings and investment accounts every single month.

This “pay yourself first” strategy ensures that your future financial goals are prioritized before discretionary spending. Automation turns wealth building into a consistent, effortless habit, putting your financial plan on autopilot and guaranteeing progress over time.

Navigating the Obstacles on the Path to Wealth

The path to financial independence is rarely a straight line. It is filled with potential obstacles that can derail even the most well-intentioned plans. Understanding these challenges in advance allows you to prepare for them and build the resilience needed to stay the course.

One of the most common pitfalls is lifestyle inflation. This is the natural tendency to increase your spending as your income grows. While it’s fine to enjoy the fruits of your labor, letting your expenses rise in lockstep with your earnings can trap you in a cycle of never getting ahead. Consciously directing a significant portion of any new income toward your financial goals is crucial to breaking this cycle.

Financial setbacks, such as a job loss or an unexpected major expense, are an inevitable part of life. This is why a fully-funded emergency fund, covering three to six months of essential living expenses, is non-negotiable. This safety net provides the stability to navigate emergencies without having to derail your long-term investments or go into debt.

Building wealth is a marathon, not a sprint, and maintaining motivation can be challenging. It’s easy to feel the strain, much like feeling completely tired on a Friday after a demanding week. To avoid burnout, it’s essential to build sustainable habits, celebrate small milestones along the way, and regularly remind yourself of your long-term vision. Your “why” is the fuel that will keep you going when motivation wanes.

Finally, the people you surround yourself with have a profound impact on your financial habits and mindset. If your social circle encourages overspending and instant gratification, it can be incredibly difficult to stay disciplined. Seek out friends, mentors, or communities that support your financial goals and model the behaviors you wish to adopt.

Beyond Money: Cultivating a Rich and Fulfilling Life Today

It’s a common mistake to believe that a rich life is something that begins only after you’ve reached a certain financial milestone. True wealth is not a destination to be reached in the distant future; it’s a quality of life that can be cultivated in the present, regardless of your net worth.

Wealth is ultimately a tool, not the end goal itself. Its true purpose is to enable a life of fulfillment, purpose, and joy. Deferring all happiness until you’re “rich” is a recipe for a life of perpetual dissatisfaction. The key is to find a balance between planning for a prosperous future and living a meaningful life today.

Focus on cultivating richness in non-financial areas of your life. Invest time in your relationships, prioritize your physical and mental health, and pursue hobbies and interests that bring you joy. Many of life’s most rewarding experiences, like a walk in nature or a deep conversation with a loved one, cost little to nothing. Even deciding on simple preferences, like whether you like coffee but don’t like tea, contributes to the unique texture of a rich daily life.

Practicing gratitude for what you already have can fundamentally shift your perspective from one of lack to one of abundance. When you appreciate the richness already present in your life, you build a foundation of contentment that makes the journey of wealth creation a joyful process rather than a desperate chase.

Conclusion: Your Journey from “I Wish” to “I Am”

The thought “I wish I was rich” is a powerful starting point, but it is only the beginning. True transformation happens when that passive wish is converted into decisive action. The journey to wealth is not about luck or privilege; it is about mindset, strategy, and consistent effort.

By redefining what “rich” means to you, you create a personal and motivating vision that goes far beyond a dollar amount. By adopting a mindset of abundance and discipline, you lay the psychological groundwork for success. And by following a practical, actionable blueprint, you build the habits that turn your vision into reality.

Obstacles will arise, but with preparation and resilience, they can be overcome. Remember that the ultimate goal is not just to accumulate money, but to build a life of freedom, security, and fulfillment. The journey from “I wish” to “I am” begins today, with the first conscious decision to take control of your financial destiny and build a life that is truly, deeply rich in every sense of the word.